sábado, 17 de febrero de 2018

Descubren la mayor mina de oro de la historia de China

Este depósito podría producir oro continuamente y a plena capacidad durante 40 años.

La compañía Shandong Gold Group ha anunciado este martes el hallazgo de la mayor mina de oro de China en la provincia oriental de Shandong, informa 'China Daily'.

Se reporta que el depósito, situado en la región de Laizhou-Zhaoyuan (península de Jiaodong), tiene más de 2 kilómetros de largo y alcanza los 67 metros en su parte más ancha. Debido a sus características geológicas especiales, esta región cuenta con los depósitos de oro más grandes del país.

El valor de la mina

Hasta la fecha, se han detectado 382,58 toneladas de reserva -con un grado medio de oro de 4,52 gramos por tonelada-, pero esta cifra podría aumentar hasta las 550 toneladas a medida que avance la búsqueda en los próximos dos años. Esto se traduce en un valor potencial de 150.000 millones de yuanes (unos 22.000 millones de dólares).

Se reporta que si se procesaran 10 toneladas al día, la mina podría producir oro continuamente y a plena capacidad durante 40 años.

Pulverizing electronic waste is green, clean - and cold

Researchers at Rice University and the Indian Institute of Science have an idea to simplify electronic waste recycling: Crush it into nanodust.

Specifically, they want to make the particles so small that separating different components is relatively simple compared with processes used to recycle electronic junk now.

Chandra Sekhar Tiwary, a postdoctoral researcher at Rice and a researcher at the Indian Institute of Science in Bangalore, uses a low-temperature cryo-mill to pulverize electronic waste - primarily the chips, other electronic components and polymers that make up printed circuit boards (PCBs) - into particles so small that they do not contaminate each other.

Then they can be sorted and reused, he said.

The process is the subject of a Materials Today paper by Tiwary, Rice materials scientist Pulickel Ajayan and Indian Institute professors Kamanio Chattopadhyay and D.P. Mahapatra.

The researchers intend it to replace current processes that involve dumping outdated electronics into landfills, or burning or treating them with chemicals to recover valuable metals and alloys. None are particularly friendly to the environment, Tiwary said.

"In every case, the cycle is one way, and burning or using chemicals takes a lot of energy while still leaving waste," he said. "We propose a system that breaks all of the components - metals, oxides and polymers - into homogenous powders and makes them easy to reuse."

The researchers estimate that so-called e-waste will grow by 33 percent over the next four years, and by 2030 will weigh more than a billion tons. Nearly 80 to 85 percent of often-toxic e-waste ends up in an incinerator or a landfill, Tiwary said, and is the fastest-growing waste stream in the United States, according to the Environmental Protection Agency.

The answer may be scaled-up versions of a cryo-mill designed by the Indian team that, rather than heating them, keeps materials at ultra-low temperatures during crushing.

Cold materials are more brittle and easier to pulverize, Tiwary said. "We take advantage of the physics. When you heat things, they are more likely to combine: You can put metals into polymer, oxides into polymers. That's what high-temperature processing is for, and it makes mixing really easy.

"But in low temperatures, they don't like to mix. The materials' basic properties - their elastic modulus, thermal conductivity and coefficient of thermal expansion - all change. They allow everything to separate really well," he said.

The test subjects in this case were computer mice - or at least their PCB innards. The cryo-mill contained argon gas and a single tool-grade steel ball. A steady stream of liquid nitrogen kept the container at 154 kelvins (minus 182 degrees Fahrenheit).

When shaken, the ball smashes the polymer first, then the metals and then the oxides just long enough to separate the materials into a powder, with particles between 20 and 100 nanometers wide. That can take up to three hours, after which the particles are bathed in water to separate them.

How to Properly Recycle Electronics Avoiding Environment, Human Rights Abuse

How to Properly Recycle Electronics Avoiding Environment, Human Rights Abuse

Not all aging gadgets will be safely dismantled and have their components scrapped or re-used when dropped off at local US recycling centers, according to Basel Action Network (BAN), an environmental nonprofit.

Electronics recycling often involves a complex, multi-step supply chain. Many of the downstream operations are in the developing world, where waste is exported for treatment. Once it arrives for processing, oversight can be minimal.

This can lead to unsafe labor and environmental conditions having a devastating impact on the countries receiving electronics recyclables according to BAN. The ostensibly well-intended act of recycling has the potential to harm workers, their communities, and the environment. BAN suggests that greater transparency in electronics recycling supply chains is one way companies could help.

As part of its long-standing commitment to responsible processing of used electronics, HP is disclosing the names and locations of its recycling vendors.

By bringing transparency to its electronics recycling supply chain, HP seeks to inspire other tech companies, retailers, and distributors to follow suit as well as to acknowledge the work of recycling partners to meet higher expectations. This transparency also helps HP customers feel confident their end-of-life equipment is adequately treated to ensure data and privacy protection.

"HP is disclosing its recycling partners to raise the bar for transparency in our industry and to highlight the high standards we set for those vendors," said Annukka Dickens, HP Director of Human Rights and Supply Chain Responsibility. "We challenge other companies in and outside of the high tech industry to follow our lead and disclose recycler vendor standards and performance, as well as the list of recycling vendors they employ globally."

Ties Back to the Circular Economy

A key part of HP's circular economy strategy is responsible recycling of used electronics, which encompasses industry-leading recycling and reuse standards, a robust recycler audit program, and close engagement with recycling partners.

In addition to transparency in HP recycling programs, they are also reducing resource consumption by reinventing product design to extend the life of products, shifting to service models, and transforming how whole industries design, make, and distribute products through disruptive technologies, such as 3D printing.

The End-of-Life Electronics Challenge

HP knows from experience that recycling responsibly is no small effort. The company is one of high tech's most active recyclers. They have recaptured and recycled over 3.3 billion pounds of computer and printing hardware and 682 million ink and toner cartridges since in the past 30 years.

HP also offers takeback and recycling programs to keep used electronics and printing supplies out of landfills in more than 70 countries and territories through its HP Planet Partners program. It also collaborates with governments and industry stakeholders to promote innovative solutions for managing electronics equipment at the end of its life cycle.

As part of the company's stringent recycling vendor management process, HP requires every specialist vendor to execute environmentally-responsible processing techniques, comply with relevant government regulations, and achieve additional commitments like ethical labor practices and conformance to the Basel Convention, which limits shipment of non-functional electronics between countries.

In addition, vendors must attain third-party certification, such as e-Stewards, R2, or WEEELABEX, where applicable, and must also submit to regular audits.

Collaboration to Ensure Performance

In 2015, HP conducted audits at 58 facilities in 20 countries, including audits to follow-up on previous findings and confirm ongoing commitment to responsible practices and improved performance.

In extreme cases, vendors are not allowed to continue recycling on HP's behalf if they do not work to address nonconformance identified during audits.

"People should know how and where their equipment is recycled. We encourage customers to ask questions about what really happens to the equipment they return," Dickens said.

martes, 6 de febrero de 2018

Científicos descubren cómo una bacteria convierte toxinas en oro (FOTO)

pixabay.com / skeeze

En un estudio realizado en el año 2009, expertos alemanes y australianos demostraron que la bacteria C. metallidurans puede producir oro de manera biológica.

Un equipo de científicos alemanes y australianos ha desentrañado los procesos molecurales que tienen lugar en el interior del bacilo C. metallidurans, una bacteria capaz de digerir metales tóxicos y convertirlos en oro. Los investigadores difundieron los resultados en un estudio publicado el pasado miércoles. El equipo científico está formado por expertos de la Universidad Martín Lutero (UML), de Halle-Wittenberg, en Alemania, la Universidad Técnica de Munich y la Universidad de Adelaida, en Australia.

La bacteria C. metallidurans vive principalmente en suelos con alto contenido de metales pesados. Con el paso del tiempo, algunos minerales se descomponen y liberan metales pesados tóxicos e hidrógeno en su entorno. Pero más allá de la prensencia de estos últimos, "las condiciones de vida en esos suelos no son malas. Hay suficiente hidrógeno para conservar energía y casi no hay competencia. Si un organismo opta por sobrevivir aquí, tiene que encontrar una manera de protegerse de estas sustancias tóxicas; la bacteria C. metadillurans lo ha hecho", asegura Dietrich H. Nies, profesor de microbiología molecular en la UML y autor principal del estudio.

El oro se introduce en la bacteria del mismo modo que lo hace el cobre. El cobre es un elemento vital para la bacteria C. metadillurans, pero es tóxico en grandes cantidades. Cuando las partículas de cobre y oro entran en contacto con dicha bacteria, se produce una serie de procesos químicos. Si se hallan ambas en el interior de la bacteria, se suprime la enzima CupA, que es la encargada de expulsar las partículas de cobre, en tanto que los compuestos tóxicos de cobre y oro permanecen en el interior de la célula.

Las bacterias activan entonces la enzima Cop A, la cual transforma los compuestos de ambos metales en formas originalmente díficiles de ser absorbidos, de modo que menos compuestos de cobre y oro entran en el interior de la célula. En consecuencia, se elimina el exceso de cobre, y los compuestos de oro, que son díficiles de absorber, se convierten en pepitas en el área exterior de la célula.

La bacteria C. metallidurans juega un papel fundamental en la formación del llamado oro secundario, que se genera en la naturaleza a raíz de la descomposición de minerales de oro primarios. El estudio realizado por el equipo científico germano-australiano ha proporcionado información relevante sobre el ciclo biogeoquímico del metal precioso. En un estudio realizado en el año 2009, los científicos habían ya demostrado que la bacteria C. metallidurans puede producir oro de manera biológica. Pero desconocían el porqué de este proceso de conversión.

domingo, 20 de agosto de 2017

México prepara estrategia nacional para reducir emisiones de mercurio

wikipedia.org

Las autoridades ambientales mexicanas buscan ponerse a tono con el Convenio de Minamata, que entró en vigor esta semana.

México anunció que diseñará una estrategia para cumplir con el Convenio de Minamata, cuyo objetivo es reducir las emisiones de mercurio, un metal pesado que provoca graves daños a la salud humana y el medio ambiente.

El gobierno de Enrique Peña Nieto prepara un diagnóstico de la situación nacional sobre el mercurio, a raíz de la entrada en vigor este miércoles del Convenio de Minamata, ratificado por el país latinoamericano.

"A finales del presente año se tendrá lista una estrategia para atender este problema", informó la Secretaría del Medio Ambiente y Recursos Naturales (Semarnat) en uncomunicado.

Los efectos dañinos de este metal para la salud humana fueron identificados en los años 50 tras la catástrofe de la Bahía de Minamata (Japón), ocasionada por unafábrica de productos químicos que arrojó al agua metilmercurio, un compuesto altamente tóxico, reportó el portal 20 Minutos.

La Organización Mundial de la Salud (OMS) ha determinado que "la exposición a ese metal pesado ocasiona daños cerebrales y neurológicos, principalmente a los jóvenes". A ello se agregan efectos nocivos en pulmones, riñones, sistema nervioso, digestivo e inmunológico.

domingo, 30 de abril de 2017

Inside The World's Top Copper Nations - ValueWalk

I’ve talked a lot lately about the rise of Peru. With this week’s apparent approval of the new Quellaveco mega-mine being the latest addition to output here.

The emergence of new Peruvian mining projects is big news for the global copper market. Because there’s been a lot of question lately about where supply growth globally might be coming from.

As the chart below shows, Peru is a big part of the answer. Of the world’s top copper-producing nations, Peru is the only one showing significant yearly production growth over the last five years.

Peru is the only one among the world’s top copper-producing nations to show sustained and significant growth over the last five years (source: U.S. Geological Survey)

Between 2012 and 2016, Peru’s copper production jumped 77% to 2,300 tonnes per year. Putting it solidly into second place in global output.

During the same period, other big copper nations struggled. Top producer Chile was flat, as were #3 and #5 China and Australia.

Number-four copper producer America has managed to steadily grow production each year since 2012. But the scope has been small — with U.S. producers upping output by 20.5% or 240 tonnes per year. Not even a quarter of the supply growth Peru has seen.

But there is one other nation that was having a good run the past half-decade: Africa’s top copper producer, Democratic Republic of Congo.

As the chart above shows, DR Congo saw a big growth spurt between 2012 and 2014 — when copper production jumped 430 tonnes, or 72%.

But then, producers hit the wall. Output in 2015 was flat, before falling to 910 tonnes in 2016 as copper prices declined.

The big reason DR Congo stalled is electricity. This is a massive country — the 11th largest in the world by area — but has one of the lowest rates of national electricity availability.

Look at some numbers. Nationwide, only 9% of DR Congo’s population has access to electricity. Even in urban centers, the electrification rate is just 19% — dropping to 1% in the countryside.

The government here has tried to allocate power to the copper mining sector. But there just isn’t enough to go around — only about half of the nation’s 2,500 MW of installed generating capacity (almost entirely hydropower) is functional.

Nationwide the power shortfall is estimated at 750 MW. With the mining sector alone short about 300 MW.

That lack of power has almost completely frozen new mine development. Which is why this week’s power import deal with South Africa is so critical — if more electricity does arrive, things could be de-bottlenecked enough to get new operations up and running.

That would be very significant for global copper supply. Potentially allowing DR Congo’s output to resume the upward trend it enjoyed during 2012 to 2014.

In fact, the country might be one of the only places with big growth potential outside of Peru.

There’s no shortage of in-ground copper resources in DR Congo — unlike the U.S. and Australia, where big, new discoveries are hard to come by (although developments like in-situ leaching in Arizona could change that).

The country is also largely free of the regulatory problems and social opposition that have plagued Latin American copper nations. It has its own challenges to be sure — but the government has shown willingness to move developments along, unlike spots like Chile where lawmakers are getting more restive.

Even Peru’s future is uncertain. Anglo American walked away from the Michiquillay project a few weeks ago, saying government terms were too steep. And big copper mines in the country like Las Bambas have seen significant protests from local communities the past year.

DR Congo’s power problems aren’t easy to solve. Even the term sheet signed this week with South Africa’s Eskom still has a way to go — with lingering doubts over the Congolese ability to pay bills being a potential stumbling block.

But if an import deal can get done, it opens up one of the clearest paths to copper supply growth anywhere in the world. That’s a key development to watch for all market players, including project developers.

jueves, 20 de abril de 2017

Huge Decline In Peru's Silver Production Suggests Future Supply At Risk

The Peru Ministry of Energy and Mining just released their silver production data for February, and it was a whopper to the downside. Actually, I was quite surprised to see how much the country's silver production declined versus the same month last year. Also, Peru's gold production in February took a similar big hit.

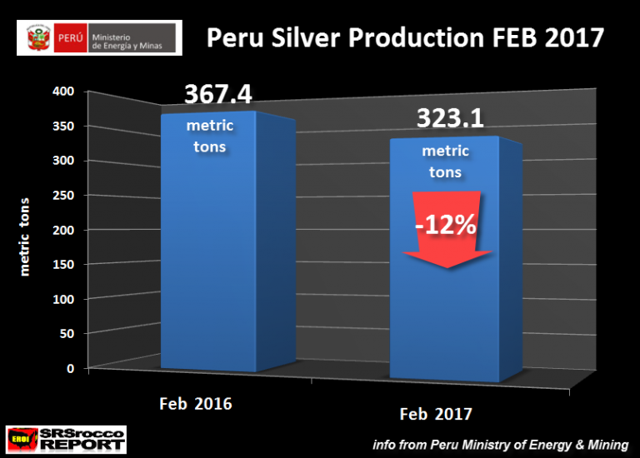

According to the ministry data, the country's silver production fell 12% to 323.1 metric tons (mt) this February versus 367.4 mt the same month last year:

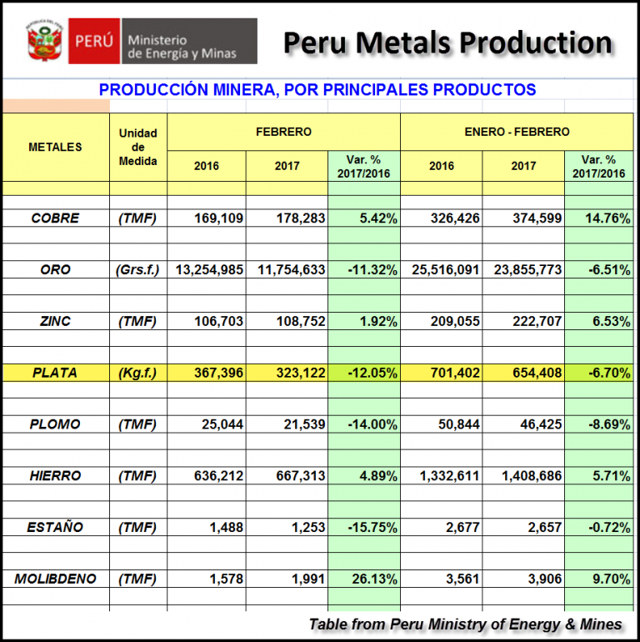

This is a 44 mt decline in one month, nearly 1.5 million oz lost. Here is the table from the Peru Ministry of Energy and Mining showing various metals production data for February:

Silver is shown as "PLATA," and as we see, overall silver production for January-February has declined 6.7% compared to the same period last year. Which means, Peru's silver production took a much larger hit in February than in January.Furthermore, the country's gold production (shown as "ORO") also declined significantly by falling 11.3% in February.

The Peru Ministry of Energy and Mining put out this brief explanation why their silver and gold production declined in February:

However, in this month precious metals slightly suffered a lower production volume gold decreased by -11.91%, while silver -11.29%. In the accumulated January, national production of these precious metals decreased by 6.81% for gold and 6.3% for silver.

In the national production of silver, the Lima region (127,157 kg fine), Ancash (126,816 kg fine) and Junín (116,473 kg fine) regions are in the top positions, associated with the polymetallic exploitation of the center of the country. Peru is the second largest silver producer in the world and boasts the largest proven and probable reserves of this precious metal in the world.

Antamina (101,824 kg Fine) in the Ancash region, followed by Uchucchacua (84,745 Kg. Finos) in Lima and Inmaculada (30,468 Kg Finos) in Ayacucho, among several others.

In the case of gold, the national production accumulated to February 2017, reached 23.8 tons fine. Its production was concentrated in the regions of La Libertad (6.4 tons) contributing the total production in 26.92%; Cajamarca cooperating with 23.32% (5.5 tons fine) and Arequipa (3.03 tons fine) contributing 12.74%. These regions accumulate 63% of the national gold production.

The decrease is explained by the lower results (-23.53%) of the main producer: Minera Yanacocha S.R.L. Whose operations in Cajamarca have been affected by an exhaustion of the reserves in the current deposits in operation.

I don't know why the ministry's data for gold and silver production declines are different in their explanation than what they show in the Excel spreadsheets. However, it is only off by a small percentage. Regardless, the important part of the text above is highlighted in red. The reason for the big decline of Peru's gold production was due to "an exhaustion of reserves in the current deposits of operation." This is a key factor that will be played out across the world as other mines lose production due to the same situation of reserve exhaustion.

We must remember, Peru is the second largest silver producer in the world, right behind Mexico. According to the Silver Institute's 2016 Interim Report, Mexico's silver production is estimated to decline to 183 Moz in 2016 (189 Moz in 2015), while Peru's silver production increased to 141 Moz (136 Moz in 2015).

Global Future Silver Production At Risk

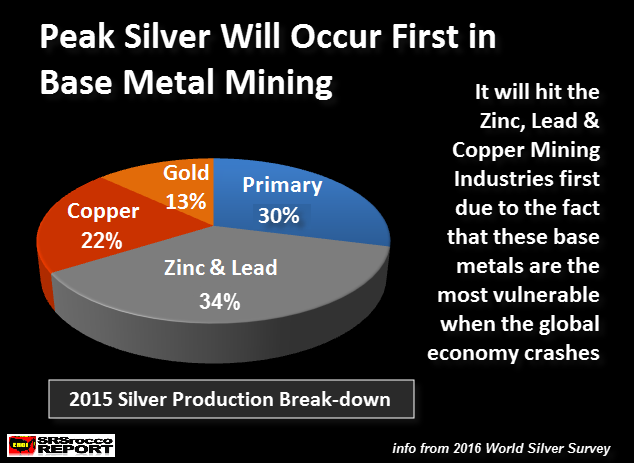

As the global markets finally succumb to the massive amount of debt, economic activity is going to plummet. This will have a negative impact on most energy, metals and commodity prices. Thus, production of base metals will decline significantly. This will impact the production of silver the most, as the majority comes as a by-product of zinc, lead and copper production.

According to the World Silver Survey, 34% of silver production came as a by-product of zinc and lead mine supply, while 22% came as a by-product of copper production. Thus, 56% of global silver production is a result of copper, zinc and lead production:

Which means more than half of the world's future silver production is at risk when base metals prices take a big hit during the next economic crash. People need to realize that using a massive amount of leveraged debt to continue economic activity is not only unwise, it is seriously insane.

While there is no guarantee what the value of gold and silver will be in the future, logic suggests investors holding onto moststocks, bonds and real estate will suffer the financial enema of their life. Again, this is all due to the disintegrating U.S. and global oil industry in the future.

So, place ya bets and let's see who made the better investment decision when the global market finally cracks.